Nickel

Go-to-market research for the launch of a new payment institution in Belgium.

The customer

French fintech company Nickel wants to offer basic current accounts, through an extensive network of newspaper shops in Belgium. The goal is that anyone can open an account within 5 minutes, no paperwork or waiting period needed.

The choice of a physical network in addition to the digital services, is unique within the fintech world. Nickel wants to create a counter-movement to the increasing closures of bank offices. The newspaper shops will be acting as ‘mini bank offices’, accessible to anyone - even people who are excluded from traditional banking services.

Nickel is on the way up in Europe. After already serving 2 million customers in France, they entered the Spanish market in 2021. In 2022 Portugal and Belgium will be added, with a goal of 300.000 customers in Belgium in 2024.

The challenge

Nickel and Knight Moves joined forces for a successful launch in Belgium. The challenge was to define the Belgian value proposition and to develop a marketing and communication strategy alongside it.

Insights into the target group and personas

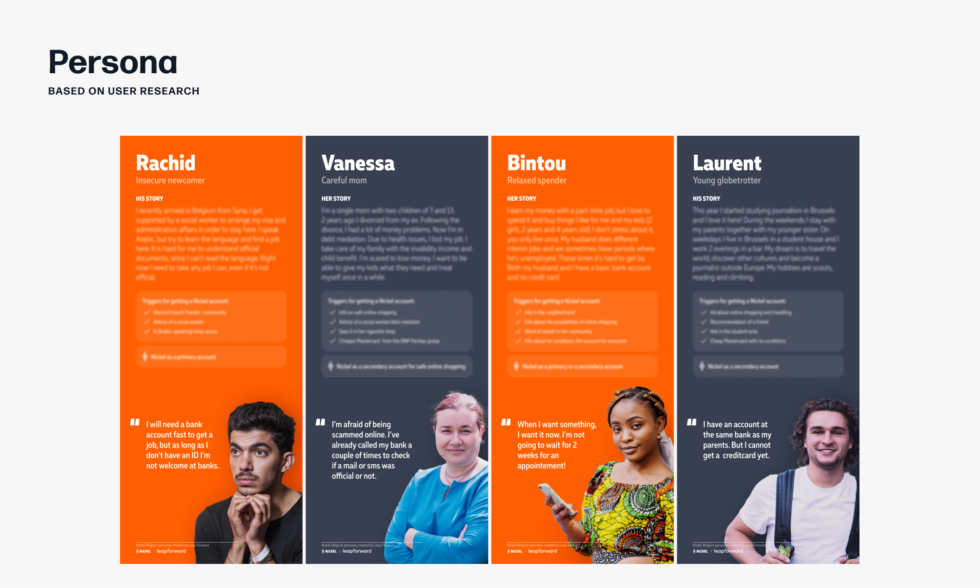

The first challenge was to find the target audience for Nickel in Belgium. For the French market, distinct persona’s were already created, but we had to find out to what extent the needs of the Belgian audience were comparable.

Regional differences between Flanders and Wallonia were also taken into account. Does a Flemish person have a different outlook on their finances than a Walloon?

One of the promises that Nickel makes is to give anyone access to basic banking services, like a simple debit Mastercard. In doing so, they reach people that normally are excluded by the traditional major banks - or sometimes even people who are banned from other banks. In this target market are newcomers without documents, people who are unemployed or people with a low-income and debts. In the user research we focused specifically on reaching these vulnerable target audiences.

Translation into a communication strategy

A second challenge was the translation of the user research and insights into an effective marketing and communication strategy. How can we translate value propositions into a slogan or ads? Which messages resonate most with Flemish and Walloon people?

Besides this, the website and user interfaces have to be adapted to the Belgian market. Which local differences impact the UX?

Action points

User research with vulnerable target audiences

Research around the needs and expectations regarding financial services by Flemish and Walloons, focussing specifically on vulnerable target groups.

User-centric marketing & communication strategy

Development of value proposition and communication messages. These were again validated on clarity and impact for the different target audiences.

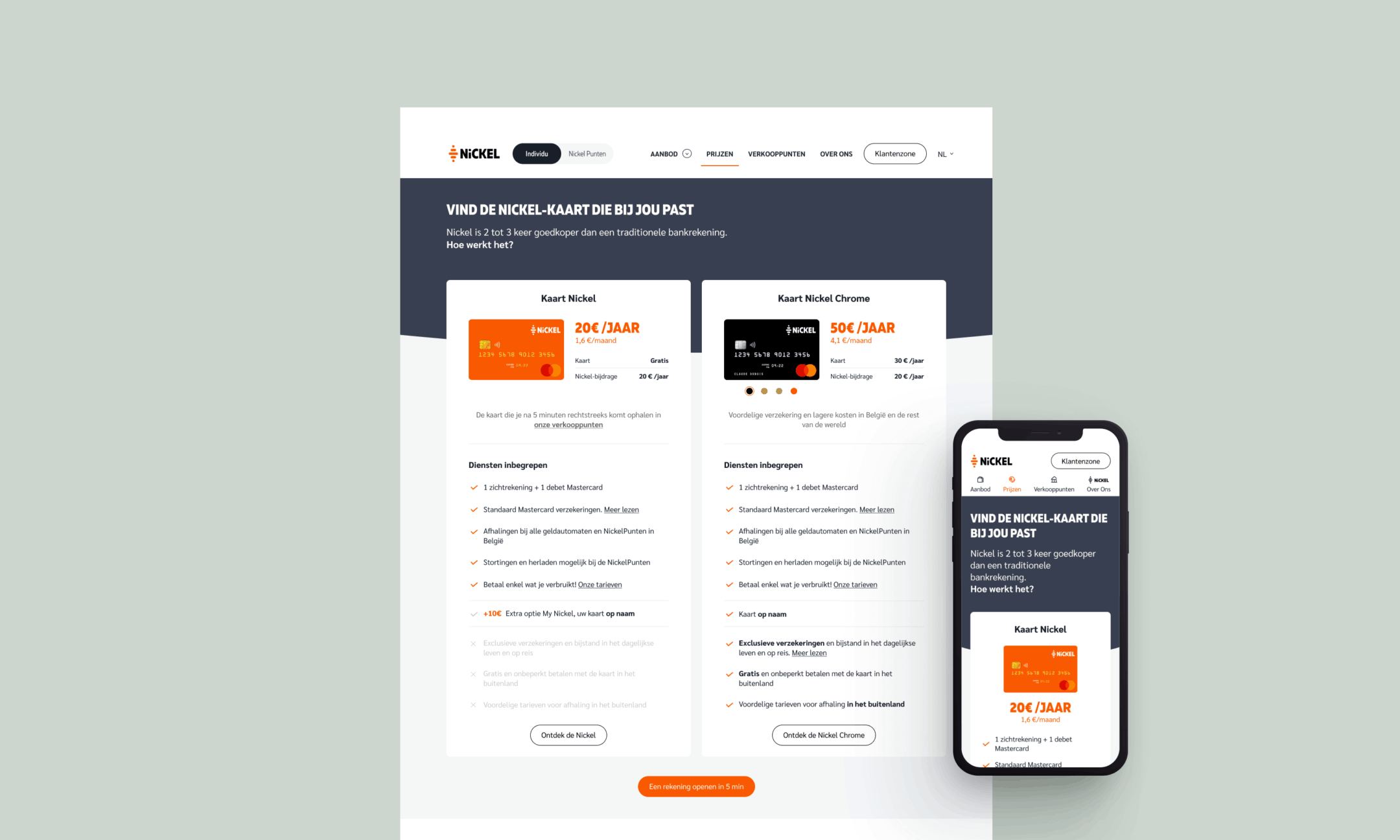

Optimisation of digital touchpoints

UX and content optimisation of the app and website for end users and the interface for owners of newspaper shops.

The quest

To define the potential Belgian market we learned about customer trends and future developments within the financial services sector. After we’ve proven our conclusions with real users: using guerilla street interviews and in-depth interviews we identified the needs and expectations of prospective customers. All of these insights were translated into 4 persona’s that represent potential Belgian users.

The owners of newspaper shops were also interviewed through an online in-depth interview and a user test of the online onboarding platform. Our insights were translated to UX improvements for the onboarding tool and a value proposition to convince the newspaper shops to become a Nickel service point.

All insights were translated into different prototypes of the value proposition and a tagline. With these prototypes we went back to the street to gauge first impressions. All interviewees were divided by the persona profiles, for an equal distribution between the potential target audience.

We analysed the French website and app and formulated recommendations for modifications for the Belgian market. These modifications were then adapted in the prototypes that we showed to 12 Dutch speaking and 12 French speaking users during a usability test.

Integral user research

Carrousel

The result

We defined four new personas for the Belgian market, based on our user research. We found substantial differences between the French and Belgian market, both in needs as in the outlook on financial institutions.

A new value proposition was chosen and new USP’s defined. Although the trust in traditional banks is bigger for Belgium than for France, we still found that vulnerable groups feel excluded from certain services (for example getting a credit card or a loan). Nickel offers a solution with their quick sign up, straightforward offering and the service they offer.

The decrease in banking offices and intensive digitalisation at banks leaves a big group of people behind. Personal contact and the low threshold of the service points are a unique advantage of Nickel.

The value proposition was translated to new communication messages for both Flanders and Wallonia. These were validated by users in short street interviews.

We also identified some local UX optimisations in the app, such as introducing a structured message (which doesn’t exist in France), easy sign up using Itsme and a less complex IBAN format.